Berkshire Hathaway Bets on US Airlines

Berkshire Hathaway just disclosed that it took stakes in major US airlines. Pretty sure it is not Warren Buffett, rather his co-CIOs, making these investments. Buffett joked that he wouldn't invest in airlines after his disastrous--disaster for him is exiting with a small gain ;)--bet on US Airways in the 90's and, although he can always change his mind, I doubt he did. Also, Buffett usually makes concentrated bets and this isn't one. What is interesting to me is that they seem to be making a sector or macro bet since they took stakes in multiple airlines--either that, or they are trying to obscure their true intention (the stock they want to own) but buying multiple ones.

It was only yesterday when I was commenting on Mohnish Pabri and his investment in Southwest Airlines (LUV). I wondered if the airline industry has changed from its money-losing ways. I wonder if the Berkshire investment managers are thinking the same thing. In an interview with CNBC Buffett confirmed that Berkshire also took a stake in Southwest Airlines (this happened after the end of the quarter which the 13F filing reflects). Really interesting to see Pabri take the same position.

One possibility is that the Berkshire CIOs are betting on airlines due to the decline in oil prices, which are a major cost for airlines. Although they may factor this in somewhat, I doubt this is the case since pure value investors don't generally speculate on future commodity prices.

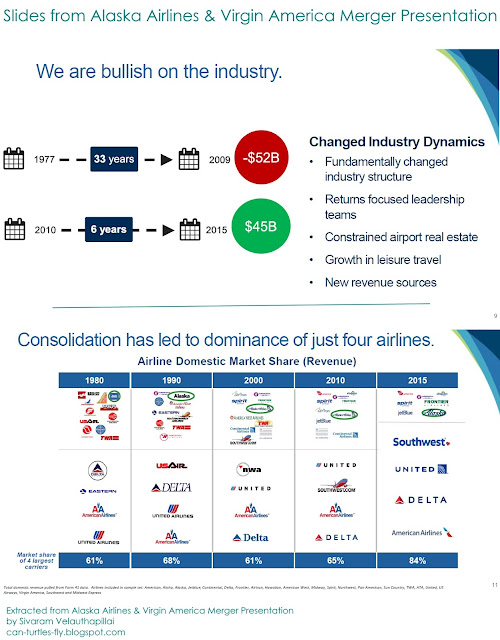

In the Alaska Airlines-Virgin America merger presentation, the following slides were presented to illustrate how the American airline industry is supposed more profitable now. This document is likely biased (since it is there to sell the merger) but it is something to think about. Has the airline industry really changed?

The bottom slide clearly illustrates that the top 4 carriers have 84% of the market share, whereas as recently as 5 years ago, it was only 65%. Either economies of scale or pricing power could have led to improved operations for those top 4 carriers.

One thing going against an investment right now is that P/E ratios are very low right now. According to this Bloomberg article, TTM P/Es for the 4 largest US airlines are around 8, with American Airlines actually trading around 5. Cyclicals should generally be bought when P/Es are high (or infinite i.e. loss). I haven't done any research but one should be careful that they are not buying these companies near peak earnings, with high risk of markdowns during economic recessions--a recession and a stock market correction is way overdue and I think we will have one very soon.

Maybe it is worth investigating airlines as potential investments. This is certainly an industry that has historically been ignored by many amateur investors, for very good reasons.

It was only yesterday when I was commenting on Mohnish Pabri and his investment in Southwest Airlines (LUV). I wondered if the airline industry has changed from its money-losing ways. I wonder if the Berkshire investment managers are thinking the same thing. In an interview with CNBC Buffett confirmed that Berkshire also took a stake in Southwest Airlines (this happened after the end of the quarter which the 13F filing reflects). Really interesting to see Pabri take the same position.

One possibility is that the Berkshire CIOs are betting on airlines due to the decline in oil prices, which are a major cost for airlines. Although they may factor this in somewhat, I doubt this is the case since pure value investors don't generally speculate on future commodity prices.

In the Alaska Airlines-Virgin America merger presentation, the following slides were presented to illustrate how the American airline industry is supposed more profitable now. This document is likely biased (since it is there to sell the merger) but it is something to think about. Has the airline industry really changed?

(source: "The Premier Airline for People on the West Coast," Alaska Airline and Virgin America. Flyingbettertogther.com)

The bottom slide clearly illustrates that the top 4 carriers have 84% of the market share, whereas as recently as 5 years ago, it was only 65%. Either economies of scale or pricing power could have led to improved operations for those top 4 carriers.

One thing going against an investment right now is that P/E ratios are very low right now. According to this Bloomberg article, TTM P/Es for the 4 largest US airlines are around 8, with American Airlines actually trading around 5. Cyclicals should generally be bought when P/Es are high (or infinite i.e. loss). I haven't done any research but one should be careful that they are not buying these companies near peak earnings, with high risk of markdowns during economic recessions--a recession and a stock market correction is way overdue and I think we will have one very soon.

Maybe it is worth investigating airlines as potential investments. This is certainly an industry that has historically been ignored by many amateur investors, for very good reasons.

Kütahya

ReplyDeleteistanbul

Çankırı

Malatya

Maraş

HKOİ0

Kocaeli

ReplyDeleteDenizli

Bartın

Kocaeli

Adana

BGKO5

4AA7D

ReplyDeleteBartın Şehir İçi Nakliyat

Bitci Güvenilir mi

Yalova Şehirler Arası Nakliyat

Bartın Şehirler Arası Nakliyat

Gölbaşı Fayans Ustası

Isparta Parça Eşya Taşıma

Denizli Şehir İçi Nakliyat

Kütahya Şehirler Arası Nakliyat

Çerkezköy Koltuk Kaplama

3A9E9

ReplyDeleteen iyi görüntülü sohbet uygulaması

samsun görüntülü sohbet siteleri ücretsiz

denizli kızlarla canlı sohbet

antalya sohbet uygulamaları

burdur sesli mobil sohbet

ankara rastgele canlı sohbet

çorum en iyi görüntülü sohbet uygulamaları

erzurum muhabbet sohbet

tekirdağ rastgele sohbet

9E912

ReplyDeleteadıyaman rastgele canlı sohbet

tekirdağ yabancı sohbet

nevşehir chat sohbet

bedava sohbet uygulamaları

canli sohbet

trabzon mobil sohbet chat

canlı sohbet ücretsiz

mardin chat sohbet

çorum telefonda kadınlarla sohbet

EFD72

ReplyDeleteParasız Görüntülü Sohbet

Bitcoin Kazanma

Threads Yeniden Paylaş Satın Al

Binance'de Kaldıraç Var mı

Facebook Sayfa Beğeni Hilesi

Chat Gpt Coin Hangi Borsada

Kripto Para Üretme

Aion Coin Hangi Borsada

Arg Coin Hangi Borsada

802E5

ReplyDeleteDiscord Sunucu Üyesi Hilesi

Kripto Para Kazma

Bitranium Coin Hangi Borsada

Binance Yaş Sınırı

Tumblr Beğeni Hilesi

Binance'de Kaldıraç Var mı

Telegram Görüntüleme Satın Al

Binance Hangi Ülkenin

Ön Satış Coin Nasıl Alınır

17DBC

ReplyDeleteBitcoin Yatırımı Nasıl Yapılır

Soundcloud Beğeni Hilesi

Kripto Para Nasıl Alınır

Twitter Takipçi Hilesi

Binance Referans Kodu

Snapchat Takipçi Hilesi

Alyattes Coin Hangi Borsada

Linkedin Takipçi Satın Al

Kwai Beğeni Hilesi

B1C0F

ReplyDeleteFacebook Takipçi Hilesi

Gate io Borsası Güvenilir mi

Twitter Takipçi Hilesi

Telegram Abone Satın Al

Mexc Borsası Kimin

Coin Nasıl Çıkarılır

Btcturk Borsası Güvenilir mi

Threads Beğeni Hilesi

Btcturk Borsası Güvenilir mi

شركة تسليك مجاري بالدمام XDmeNcj81E

ReplyDeleteشركة عزل اسطح بالافلاج l3wiIempIi

ReplyDelete1876C3B5E4

ReplyDeletegarantili takipçi

instagram beğeni satın al

güvenilir takipçi

tiktok takipçi

bayan takipçi