Oil stocks look interesting

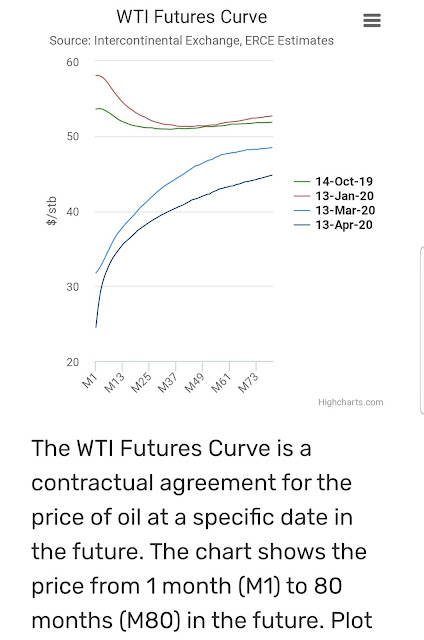

One of the most interesting sectors for contrarian investors is oil. Oil stocks have crashed and oil price itself has not recovered in the last few weeks (although oil stocks are up 50% from bottom so some positive economic recovery is priced in). Current WTIC oil price is around $21. It should be noted that oil price is even lower than it was a few weeks ago even though OPEC, Russia, USA and others have agreed to reduce production. This goes to show how political oil is--hence unpredictable. But if you think oil is low, the unpredictability is not a big risk since upside near a bottom is higher than downside (in fact, there is probably higher chance of it going up due to political events; this is obviously not true if oil price was high or during normal price). Shown below is the WTIC futures curve from 1 month to 80 months: Source: ERCE, https://www.erce.energy/graph/ wti-futures-curve Futures are forecasting above us$35/bbl (WTIC) beyond 2 years. You can't bli