Japan Stock Research Tips

Well, it`s time to revisit Japan. If you need a reason, how about Marc Faber. It looks like Marc Faber shares similar views as me regarding Japan. He seems to be bullish on Japanese small-caps and the Yen (On a side note, this is probably the first time I have seen him suggest shorting emerging markets. He has been a superbull on EM and commodities so this is a major change in my eyes and something to watch out for).

I'm just a newbie when it comes to investing and thought I would write up some techniques and methods I'm using when researching Japanese stocks. I will primarily talk about researching stocks listed on Japanese stock exchanges. Some of these stocks may trade in New York or on the Pink Sheets but anyone that is as bullish as I am should probably consider opening up a brokerage account that allows you to buy directly on the Tokyo Stock Exchange (or one of the other exchanges in Japan) for a low commission. What I have done is to open up a Yen-denominated brokerage account at HSBC (I'm in Canada but it should be similar elsewhere). Since I am bullish on the Yen, what I have been doing is transferring money into the Yen account whenever I save a meaningful amount.

Before I say anything, note that some information can be out of date and/or misleading so you should double-check everything by reading official company documents. For example, some of the P/E ratios listed on the Tokyo Stock Exchange website were wrong because they didn't incorporate stock-splits that occured recently. I was looking at something that had a P/E of 3 but it was actually more like 9.

Company Website

If you know the company that you are intersted in, just Google for it on the web and go to their website. Many of the large-cap and mid-cap companies have English investor relations information. Annual reports, news releases, and so forth, can be found on their site.

Company Info from Reuters

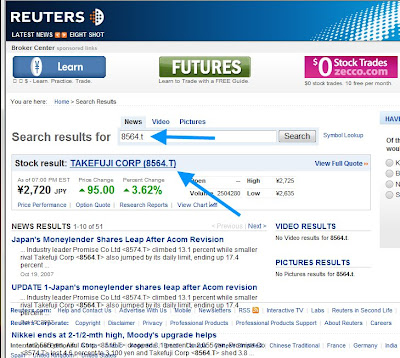

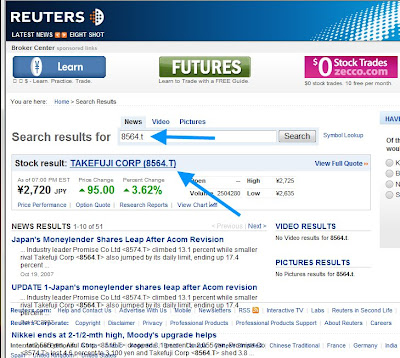

I find reuters.com to be the best place to get stock information (eg. market cap, dividend, earnings estimates, etc) for Japanese stocks. Use the following suffix ".T" for Tokyo Stock Exchange listed stocks (other Japanese exchanges have different suffix). For example, enter "8564.T" in the search box at the top right on the main reuters site.

If you wait a while, the search result should list a box near the top with the stock info. Click on that box to go to the stock info page.

Japan Company Handbook

If you want something similar to a Stock Guide from S&P or Value Line, the Japan Company Handbook seems to fit the bill. You can buy it from Amazon or some bookstore. You may also be able to find it in your local library. I really haven't used it so I don't know how good it is. The samples on their website makes me think the data is very sparse and is only a starting point (similar to the S&P guides). I simply ran across it and thought some of you may find it useful. Unlike online stock information from Reuters, these guides generally have multi-year information and seem to have sales broken down by segment.

If you want to be the next Warren Buffett, you need to be thumbing through these books (or at least some online equivalent). Remember how Buffett said he was thumbing through Moody's stock guides (now called Mergent); or how he was looking through a book on Korean stocks a few years ago and found some flour mill with a P/E of 3 (or something like that). (oh, if you do become the next Warren Buffett, make sure to send me a small little check for my help. Don't be cheap and make sure it has a lot of trailing zeroes in the number ;) ).

Charting Japanese Stocks

If you want to plot Japanese stocks, I find bigcharts.com to be good for foreign stocks. Use the following prefix "JP: " when entering the symbol. For example, "JP: 8564" for Takefuji.

Researching Unknown Stocks from Index Listings

If you don't know what you are looking for (eg. if you want to look at small-cap consumer staples), one place to look is some of the popular Japanese indices. Since I'm looking at small-caps, here are two useful indices to look at:

I believe both of these have ETFs, so you should be able to get index constituents from the ETF website (if not, then you have to go to the index provider--I don't have those URL handy). You can also get ideas from Japanese mutual funds.

Once you go through the list, you should be able to pick off a few that you like (say, small cap retailers) and then Google for more information. Unfortunately, many small caps don't have English information so you either have to blindly buy a basket of stocks, a la Benjamin Graham, or look at mid-caps.

Researching Unknown Stocks at the TSE Website

I spent many months looking for a filter for Japanese-listed stocks. You know, something where I can search by low P/E or have a listing comparing Price-to-Book. Well, I didn't realize the Tokyo Stock Exchange's advanced search is good enough for my purposes. Go to the Tokyo Stock Exchange website and click on the 'stock price advanced search' buttom, as shown below:

Then pick the areas of the exchange you want to search. First Section is typically large-caps, while the Second Section is small-caps.

In this example, Here are the results where I filter for everything in the 1st and 2nd sections in the food industry:

You can flip through this list to find something that may interest you, then click on it to get some information and do further research. Always note the volume and price in order to avoid thinly traded stocks. I personally would only stay in the 1st Section given the need for English documents.

As I have mentioned in prior posts about Japan, most Japanese companies have low ROE (Return on Equity). In the results you will see that practically everything has an ROE around 5%. You will also notice that a lot of them are trading below book value. Anyone investing in Japan has this dilemma of low Price-to-book but very low ROE as well. Perhaps one solution is to find something with low P/E ratio in order to compensate for low ROE. Perhaps something with low P/B and P/E while having low ROE can be profitable. Anyone have any thoughts?

That's it for now... if anyone has any Japanese stock ideas, feel free to leave a coment...

I'm just a newbie when it comes to investing and thought I would write up some techniques and methods I'm using when researching Japanese stocks. I will primarily talk about researching stocks listed on Japanese stock exchanges. Some of these stocks may trade in New York or on the Pink Sheets but anyone that is as bullish as I am should probably consider opening up a brokerage account that allows you to buy directly on the Tokyo Stock Exchange (or one of the other exchanges in Japan) for a low commission. What I have done is to open up a Yen-denominated brokerage account at HSBC (I'm in Canada but it should be similar elsewhere). Since I am bullish on the Yen, what I have been doing is transferring money into the Yen account whenever I save a meaningful amount.

Before I say anything, note that some information can be out of date and/or misleading so you should double-check everything by reading official company documents. For example, some of the P/E ratios listed on the Tokyo Stock Exchange website were wrong because they didn't incorporate stock-splits that occured recently. I was looking at something that had a P/E of 3 but it was actually more like 9.

Company Website

If you know the company that you are intersted in, just Google for it on the web and go to their website. Many of the large-cap and mid-cap companies have English investor relations information. Annual reports, news releases, and so forth, can be found on their site.

Company Info from Reuters

I find reuters.com to be the best place to get stock information (eg. market cap, dividend, earnings estimates, etc) for Japanese stocks. Use the following suffix ".T" for Tokyo Stock Exchange listed stocks (other Japanese exchanges have different suffix). For example, enter "8564.T" in the search box at the top right on the main reuters site.

If you wait a while, the search result should list a box near the top with the stock info. Click on that box to go to the stock info page.

Japan Company Handbook

If you want something similar to a Stock Guide from S&P or Value Line, the Japan Company Handbook seems to fit the bill. You can buy it from Amazon or some bookstore. You may also be able to find it in your local library. I really haven't used it so I don't know how good it is. The samples on their website makes me think the data is very sparse and is only a starting point (similar to the S&P guides). I simply ran across it and thought some of you may find it useful. Unlike online stock information from Reuters, these guides generally have multi-year information and seem to have sales broken down by segment.

If you want to be the next Warren Buffett, you need to be thumbing through these books (or at least some online equivalent). Remember how Buffett said he was thumbing through Moody's stock guides (now called Mergent); or how he was looking through a book on Korean stocks a few years ago and found some flour mill with a P/E of 3 (or something like that). (oh, if you do become the next Warren Buffett, make sure to send me a small little check for my help. Don't be cheap and make sure it has a lot of trailing zeroes in the number ;) ).

Charting Japanese Stocks

If you want to plot Japanese stocks, I find bigcharts.com to be good for foreign stocks. Use the following prefix "JP: " when entering the symbol. For example, "JP: 8564" for Takefuji.

Researching Unknown Stocks from Index Listings

If you don't know what you are looking for (eg. if you want to look at small-cap consumer staples), one place to look is some of the popular Japanese indices. Since I'm looking at small-caps, here are two useful indices to look at:

- S&P Japan 250 Small Cap

- Russell/Nomura Small Cap Japan

I believe both of these have ETFs, so you should be able to get index constituents from the ETF website (if not, then you have to go to the index provider--I don't have those URL handy). You can also get ideas from Japanese mutual funds.

Once you go through the list, you should be able to pick off a few that you like (say, small cap retailers) and then Google for more information. Unfortunately, many small caps don't have English information so you either have to blindly buy a basket of stocks, a la Benjamin Graham, or look at mid-caps.

Researching Unknown Stocks at the TSE Website

I spent many months looking for a filter for Japanese-listed stocks. You know, something where I can search by low P/E or have a listing comparing Price-to-Book. Well, I didn't realize the Tokyo Stock Exchange's advanced search is good enough for my purposes. Go to the Tokyo Stock Exchange website and click on the 'stock price advanced search' buttom, as shown below:

Then pick the areas of the exchange you want to search. First Section is typically large-caps, while the Second Section is small-caps.

In this example, Here are the results where I filter for everything in the 1st and 2nd sections in the food industry:

You can flip through this list to find something that may interest you, then click on it to get some information and do further research. Always note the volume and price in order to avoid thinly traded stocks. I personally would only stay in the 1st Section given the need for English documents.

As I have mentioned in prior posts about Japan, most Japanese companies have low ROE (Return on Equity). In the results you will see that practically everything has an ROE around 5%. You will also notice that a lot of them are trading below book value. Anyone investing in Japan has this dilemma of low Price-to-book but very low ROE as well. Perhaps one solution is to find something with low P/E ratio in order to compensate for low ROE. Perhaps something with low P/B and P/E while having low ROE can be profitable. Anyone have any thoughts?

That's it for now... if anyone has any Japanese stock ideas, feel free to leave a coment...

Thanks for the great post! I have been looking around reuters and the tokyo stock exchange website. There is a lot of information on international stocks which I had not been able to see before. I think my next step may be to look up on reuters as well as the tse, some of the companies listed on the international section of the ft's stock tables.

ReplyDeleteThanks again!

hpm

Make sure that you double-check the numbers that you see with the official company reports (which you can find on their website--big companies have English sites). On top of lagged data (eg. stock split not reflected), there is a lot of confusing items in Japan. Some companies operate like a holding company and the way they do financials is sometimes unusual.

ReplyDeleteVery helpful. The only place I had found was Bloomberg, which has a good quote lookup feature. Then I'd plug the data into Yahoo! Japan.

ReplyDelete