Ambac Reinsurance Notes

Neanderthal wondered about Ambac's reinsurance situation in one of the comments to a prior post of mine. His point, which is raised in the Pershing Square presentation, is whether reinsurers will be able to pay if there are massive losses. I did a quick search (the world is so much more productive with electronic PDF documents that you can search :) ) and here is what I found.

I looked at the 2006 annual report so the info is not exactly up to date. However, we are just trying to get a rough idea and although the reinsurance agreements may have changed materially in the last few months, it's probably the best info out there (unless the info is contained in some of Ambac's presentation slides or something). You can find information about reinsurance starting on page 17 in the 2006 annual report.

Ambac's Reinsurance

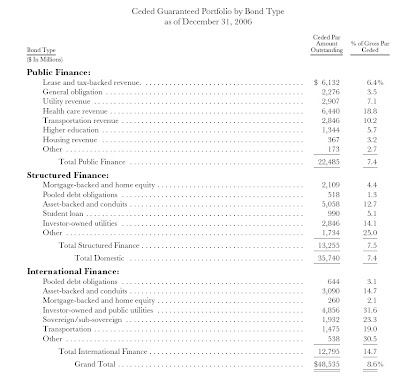

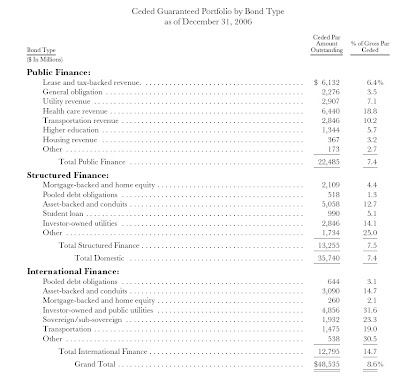

As of Dec 31, 2006, the largest reinsurer accounted for 1.8% of gross par outstanding. Given that the total outstanding insured amount is roughly $519 billion, you are looking at around $10 billion with one reinsurer. It looks like the total amount of reinsurance being used is 8.6% of par ($48.5 billion), so the largest reinsurer is responsible for about 25% of the reinsurance. If I understand it correctly, the table below shows reinsurance broken down across various types of obligation.

As you can see, there is very little reinsurance for the questionable segments like "mortgage-backed and home equity" and "pooled debt obligations". Ambac is pretty much on its own here. But it does have quite a bit of reinsurance for the "asset-backed and conduits".

Ambac's primary reinsurers are:

Well, that above list should be scary to Ambac shareholders. One might have seen a similar list elsewhere. It doesn't take long for one to realize that almost all the monolines are using the same reinsurance companies and they even reinsure each other (MBIA doing Ambac and vice versa for example). I think that's what Pershing Square was concerned with, and it's a real risk.

If there is low correlation between the monolines then a concentrated group of reinsurers isn't a big deal. For example, when MBIA had problems with Eurotunnel, other monolines had no problems (at least related to that). But when it looks like everything, including the strongest two, MBIA and Ambac, are getting hit with potential mortgage-related structured product losses, then it is fair to question whether these reinsurance companies actually will be able to pay out claims for any losses.

Risk of Reinsurer Rating Cut

On page 68, in the risk factors section, Ambac also discloses the S&P financial strength ratings of its reinsurers. Around $20.7 billion of reinsured par is with companies rated AAA and $27.7 billion are with AA-rated reinsurers. A risk to consider is what happens if the reinsurer ratings are cut. On top of the question of whether the reinsurer will be able to pay losses, it also causes a decline in Ambac's claims-paying capital amount. The reason is because highly rated reinsurance is counted at full value (100%), while those with lower rated reinsurers are counted at less value (eg. 70%). So a significant cut in a reinsurer rating may result in Ambac needing more capital to require rating agency and regulatory requirements.

Final Thought

Based on my analysis here I don't think the existing reinsurance is going to save the bond insurers. The stuff that is questionable doesn't seem to have much reinsurance. So whether these reinsurers blow up or not isn't a huge concern in my eyes.

Instead, reinsurers will play a crucial role with new reinsurance that is used. If the bond insurers need capital, they are going to have to offload their muncipal bond guarantees--needless to say, this is their most lucrative business and underpins the reason for owning the bond insurers in the first place--and what happens to this future reinsurance will have a huge impact. If they can't get enough reinsurance on decent terms then you are looking at massive share dilution (Ambac can already issue $800 million of preferred stock to a committed party but they may possibly need more (in the worst case)).

I looked at the 2006 annual report so the info is not exactly up to date. However, we are just trying to get a rough idea and although the reinsurance agreements may have changed materially in the last few months, it's probably the best info out there (unless the info is contained in some of Ambac's presentation slides or something). You can find information about reinsurance starting on page 17 in the 2006 annual report.

Ambac's Reinsurance

As of Dec 31, 2006, the largest reinsurer accounted for 1.8% of gross par outstanding. Given that the total outstanding insured amount is roughly $519 billion, you are looking at around $10 billion with one reinsurer. It looks like the total amount of reinsurance being used is 8.6% of par ($48.5 billion), so the largest reinsurer is responsible for about 25% of the reinsurance. If I understand it correctly, the table below shows reinsurance broken down across various types of obligation.

(source: Ambac 2006 Annual Report, page 18)

As you can see, there is very little reinsurance for the questionable segments like "mortgage-backed and home equity" and "pooled debt obligations". Ambac is pretty much on its own here. But it does have quite a bit of reinsurance for the "asset-backed and conduits".

Ambac's primary reinsurers are:

- Assured Guaranty Corporation

- Blue Point Re Ltd.

- FSA Guarantee

- MBIA

- Radian Asset Assurance Inc.

- Ram Reinsurance Company, Ltd.

- Swiss Reinsurance Company

- Sompo Japan

Well, that above list should be scary to Ambac shareholders. One might have seen a similar list elsewhere. It doesn't take long for one to realize that almost all the monolines are using the same reinsurance companies and they even reinsure each other (MBIA doing Ambac and vice versa for example). I think that's what Pershing Square was concerned with, and it's a real risk.

If there is low correlation between the monolines then a concentrated group of reinsurers isn't a big deal. For example, when MBIA had problems with Eurotunnel, other monolines had no problems (at least related to that). But when it looks like everything, including the strongest two, MBIA and Ambac, are getting hit with potential mortgage-related structured product losses, then it is fair to question whether these reinsurance companies actually will be able to pay out claims for any losses.

Risk of Reinsurer Rating Cut

On page 68, in the risk factors section, Ambac also discloses the S&P financial strength ratings of its reinsurers. Around $20.7 billion of reinsured par is with companies rated AAA and $27.7 billion are with AA-rated reinsurers. A risk to consider is what happens if the reinsurer ratings are cut. On top of the question of whether the reinsurer will be able to pay losses, it also causes a decline in Ambac's claims-paying capital amount. The reason is because highly rated reinsurance is counted at full value (100%), while those with lower rated reinsurers are counted at less value (eg. 70%). So a significant cut in a reinsurer rating may result in Ambac needing more capital to require rating agency and regulatory requirements.

Final Thought

Based on my analysis here I don't think the existing reinsurance is going to save the bond insurers. The stuff that is questionable doesn't seem to have much reinsurance. So whether these reinsurers blow up or not isn't a huge concern in my eyes.

Instead, reinsurers will play a crucial role with new reinsurance that is used. If the bond insurers need capital, they are going to have to offload their muncipal bond guarantees--needless to say, this is their most lucrative business and underpins the reason for owning the bond insurers in the first place--and what happens to this future reinsurance will have a huge impact. If they can't get enough reinsurance on decent terms then you are looking at massive share dilution (Ambac can already issue $800 million of preferred stock to a committed party but they may possibly need more (in the worst case)).

This is pretty scary as someone who already own the stock. The risk is that if one of the companies got down graded for reason unrelated to their reinsurance portion, as you pointed out, it would mean more capital requirement and major dilution.

ReplyDeleteOn a related point, Wallstreet Journal had an article about the subprime mortgages, It turned out that for 2006 and 2007, the credit scores of the borrowers were higher than previous years. It might be that this whole thing is not as bleak as we fear.

John

On a gloomier note today, Moody's warned that it might down grade MBI. Not a happy day, though this is not entirely unexpected as many analysis showed that they will need more capital.

ReplyDeleteJohn

I don't know what your risk tolerance is--or how much of your portfolio is in these companies--but I hope you are a fan of rollercoasters ;) The whole bond insurance sector has been bouncing up and down lately. Everything down sharply yesterday, but big bounce today...

ReplyDeleteAs AccruedInterest comments on his blog (accruedinterest.blogspot.com), the plan that is being worked on by Paulson & Company should help the monolines somewhat. So that's good news...

The bad news is that things seem to be getting worse across the board. Commerical real estate is starting to show some early signs of problems as well.

As far as MBIA needing capital, it was a surprise to me. MBIA seemed to have one of the biggest cushions based on prior analyst opinion. Furthermore, MBIA doesn't have as much exposure to CDOs. So I didn't think it would need capital.

It looks like Ambac is going to have to boost their capital. I will be curious to see how the stock price behaves upon any news of capital increase. Is that bearish news or will the stock trade up?