Sunday Spectacle CLII

Digital Economy's Shifting Industry Profits

(source: “Profit Migration in the Digital Economy,” by David Standridge and Christopher Pencavel, Booz & Company white paper, August 2011, www.booz.com/profit-migration)

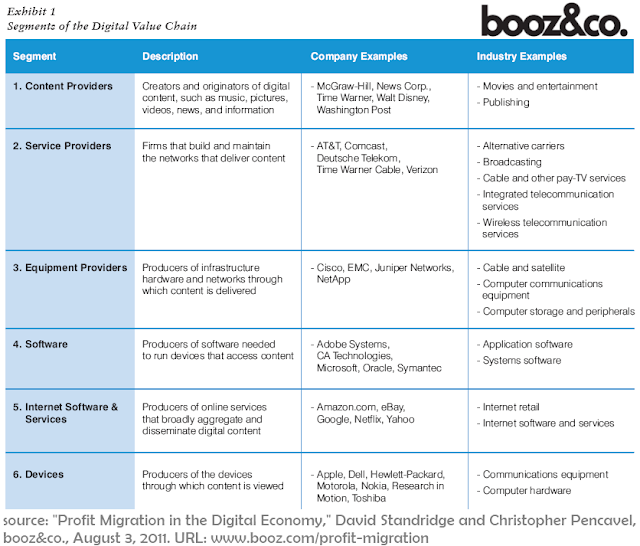

Sorry about the small fonts (I hate extracting from the booz&co reports since they aren't designed for online layouts). In any case, this is an important chart for those interested in the digital economy. Certainly any investor in the various industries that represent the 'digital economy' should pay attention to how the market is developing. Even if you don't invest in these companies, you may find the material interesting since the digital economy will play an integral role in society.

The chart from a booz&co report (read the full report for more info) illustrates how the digital economy, which includes numerous different types of industries, ranging from content creators, to service providers to software and hardware, has changed over the last 8 years. The authors picked 2002 as a starting point in order to avoid the distorting effects from the dot-com bust (I agree with their starting point decision).

One important thing to note is that the whole market is expanding so even though, say, service providers actually earn less of the total profit share, they are still bigger than they were 8 years ago. However, the declining share may indicate that the industry is saturated and has hit early-maturity.

The big increase in profitability came from Internet software and services, and from devices. The former, which includes companies like Amazon, Yahoo! and Ebay, used to post losses 8 years ago but are profitable now. A category that seemed like it had no hope back in the early 2000's, is now profitable and healthy.

The devices segment grew largely due to Apple. I never would have imagined that devices would do so well. Not only are hardware components easily duplicated by competitors, hence margins are always under threat, I also never would have expected any of them to overcome the deflationary price effect in hardware (typically hardware costs fall over time but Apple has maintained pricing for the most).

The big losers were the content providers. These are companies like Time Warner, Disney and Washington Post, who are struggling to find a business model that works in the digital economy.

It is always important to figure out which segments are profitable for investors. In any value chain, some segments are more attractive (from an ownership perspective) than others. For instance, if you look at soft drinks, a company like Coca-Cola or Pepsi earn most of the profits (and hence is attractive to investors) than the liquid supplier or bottler or distributor or the local grocery store that sells the drink. You could have made a correct bullish call on cola 80 years ago, but only certain segments were highly rewarding for investors. Since the cola market was expanding, you would still have been ok if you were the syrup ingredient supplier, but you wouldn't have been very rich. But if you bought one share of Coca-Cola 80 years ago...

In the digital value chain, content producers are losing big time right now, while content aggregators and distributors are making a killing. It's not clear to me if this is a permanent trend or if producers will gain power as the market develops. As the booz&co report mentions, entities closest to the consumer gained value while those furthest from consumers lost value (relatively speaking). Does this mean investors should favour the consumer-facing companies? Something to think about.

Comments

Post a Comment