Gary Shilling's thoughts on the next decade

I lean towards deflation, although I don't expect outright deflation* in a country like USA, so I always pay attention to one of the few deflationists around: Gary Shilling. Writing for MarketWatch, Paul Farrell, summarizes Gary Shilling's thoughts in his new book, The Age of Deleveraging. I haven't read any of Shilling's books but I do plan to get to them eventually—at the rate I'm going, it might take 249 years ;)

Shilling has been somewhat of a deflationist for almost a decade and his call in the late 90's turned out to be wrong. Needless to say, no one can predict the future precisely. However, some of his correct calls were very significant calls, such as the bullish call on US Treasuries in the 80's.

With that said, you will find below a Farrell's summary of Shilling's key calls. Most of the calls are similar to what Shilling has said in the past and as should be expected with a deflationist, it goes against the consensus (big time!). As is usual, my comments are in square brackets.

Footnote:

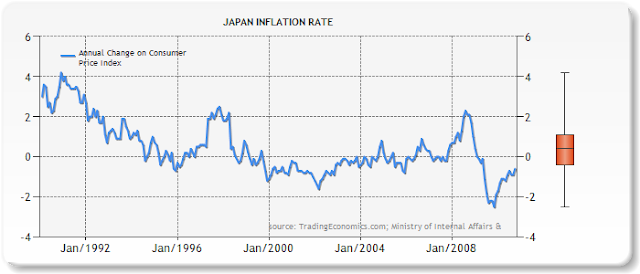

* Outright deflation without a hard currency is almost impossible. You may get a few years of negative price changes but I don't think there has been a case of negative price changes for a decade or longer. For instance, Japan is considered the classic deflation case yet price change were mostly positive. The (monthly) average since 1990 is actually a near-zero, slightly positive, rate. The following chart from Trading Economics illustrates the monthly CPI in Japan since 1990 (the orange bar on the right indicates range, max, min, and mean).

Having said all that, the GDP deflator in Japan (not shown) has clearly stayed below zero for most of the time. Some, such as Alan Greenspan, believe that the GDP deflator is a better measure of inflation than the CPI so it all depends on your beliefs

Shilling has been somewhat of a deflationist for almost a decade and his call in the late 90's turned out to be wrong. Needless to say, no one can predict the future precisely. However, some of his correct calls were very significant calls, such as the bullish call on US Treasuries in the 80's.

With that said, you will find below a Farrell's summary of Shilling's key calls. Most of the calls are similar to what Shilling has said in the past and as should be expected with a deflationist, it goes against the consensus (big time!). As is usual, my comments are in square brackets.

Twelve Sells for the Next DecadeNow for some bullish calls...

- Sell banks and similar financial institutions [goes against many value investors who are overloading on these right now]

- Sell credit-card and other consumer lenders [goes against value investors betting heavily on these]

- Sell conventional home builders and suppliers [goes against Warren Buffett who implied housing is near bottom]

- Sell commercial real estate

- Sell commodities [one of the potential areas for huge losses is commodities]

- Sell junk securities

- Sell flailing companies - “Companies with below-average revenue growth, high-fixed costs and big debts represent a lethal combination in an era of slow growth and deflation …the only route to profit gains or even stability is cost-cutting.”

- Sell big-ticket consumer purchases

- Sell low- and old-tech capital-equipment producers

- Sell antiques, art and other tangibles

- Sell developing-country stocks and bonds [the other big area for potentially huge losses lies in developing markets, which have not really corrected much in the last 10 to 12 years]

- Sell Japan - A slow train wreck. Back in his 1988 book, “After the Crash,” Shilling compared Japan’s exuberance to America’s “Roaring Twenties,” predicted they’d drop into a 1930s-type of depression. Looking to the future: “Japan’s aging and declining population and troubled export outlook may finally be catching up with it,” and the yen will continue to weaken. [this is an interesting call... I have looked hard at Japan but I can't come to any satisfactory conclusion, either way]

Ten Buys for the Next DecadeSo there you have it. Unique perspectives from an interesting fellow.

- Buy income-producing securities - Stock market’s gone nowhere for 12 years, says Shilling. Pick selective income-producers: utilities, drugs, telecoms, high-grade munis, preferreds, etc. [I don't like this strategy because it is a consensus view. Almost everyone is saying this but these people have been saying the same thing for the last 30 years—and have been right! Therefore, as a contrarian, I would be wary of income-oriented strategies. Yes, they should do well in deflationary-like scenarios but I have a feeling that a lot of companies can't sustain their dividends or bond coupons.]

- Buy American energy sources [Weird call given how he is bearish on commodities, although it's not clear if Shilling is bearish on oil & gas. The market is already pricing American (Canadian or Australian) energy companies with a safety premium so it's hard to see how you can outperform with them—unless we end up with a physical war or trade war that cuts off foreign supplies. I would not bet on this strategy.]

- Buy factory-built housing and rental apartments

- Buy health care [I don't share the same view. Although a big upside may exist, I would be nervous given how healthcare spending in most developed countries is totally out of control and unsustainable.]

- Buy the U.S. dollar [Agreed]

- Buy Treasurys and other high-quality bonds [Treasuries aren't as attractive now, unless you buy on a dip. However, high quality corporate bonds are attractive as long as inflation stays low.]

- Buy food and other consumer staples [upside low...but downside is low too]

- Buy productivity enhancers - “Anything — high tech, low tech, no tech — that helps customers reduce costs and promote productivity will be in demand.” [This is probably one areas where there is a lot of opportunity. The market, since it is tilting towards inflation, likely hasn't run up the values of such companies. If we do end up with GDP growth around 2% and inflation around 0% to 1%, I can see these companies entering a secular bull market. Having said all this, I have no idea which companies would fit the criteria. I have spent some time thinking about this, ever since I heard Shilling say it an year or two ago, but it's hard to identify these companies.]

- Buy small luxuries - Yes, frugality’s in, discounts, house brands. But still, we all have that special something. Shilling calls it “cheap chic:” You treat yourself with favorite chocolates, wine, cigars. [I don't know about this. It sort of makes sense but finding these companies is not as easy as it seems.]

- Buy investment advisers and financial planners - “Low investment returns will discourage do-it-yourself investing and encourage the use of professionals.” [oh...this is a unique call for a deflationist. Many deflationists, including me, think returns on investment are going to be low and hence people and institutions will not pursue investment returns as much. That is, people will still invest but they may invest in US Treasuries or high-quality corporate bonds, rather than shares or commodities or whatever. If anything, I think people will back away from financial planners and move towards passive investing. I don't know; that's what I'm thinking. Shilling clearly doesn't share my feeling.]

Footnote:

* Outright deflation without a hard currency is almost impossible. You may get a few years of negative price changes but I don't think there has been a case of negative price changes for a decade or longer. For instance, Japan is considered the classic deflation case yet price change were mostly positive. The (monthly) average since 1990 is actually a near-zero, slightly positive, rate. The following chart from Trading Economics illustrates the monthly CPI in Japan since 1990 (the orange bar on the right indicates range, max, min, and mean).

Having said all that, the GDP deflator in Japan (not shown) has clearly stayed below zero for most of the time. Some, such as Alan Greenspan, believe that the GDP deflator is a better measure of inflation than the CPI so it all depends on your beliefs

The dollar is doomed. So far I've made excellent progress shorting the US dollar.

ReplyDeleteI don't know about that. I lean in the deflation direction so I expect the US$ to strengthen against other currencies (and likely even gold in the somewhat distant future).

ReplyDeleteWhen did you start shorting the US$? It's stronger now than it was in early 2008. An interesting thing I notice is that the US$ has basically gone flat against the Canadian dollar (i.e. has not weakened); whereas it was weakening against it for most of the early 2000's. If the US$ has stabilized against a super-charged commodity currency like the C$, I wonder if the market is signalling a bottom for the US$.

On January 2009, when the Obama budget was announced, I blogged on how I believed it would cause inflation. Then, I began to turn all my available US funds into loonies. In February, 2009, I opened up my US margin account (before it was a cash only account), and was then able to borrow against my Canadian equities; I used the borrowed US funds to go long on Enerplus, Barrick Gold, and Carribean Utlities (because of its dividend). When I took profits, I changed the excess into loonies. In March, I went to the options conference held at the Toronto convention Centre, and started selling puts in April: on PWE, PGH, ABX, GG, NGD, ERF on the NY exchange, and lowered my cost of carry because I preferred selling puts to holding long positions.

ReplyDeleteThe long term trends of the greenback vs. the loonie or gold are the same as they were in 2008 when the loonie reached ca. $1.10. The market collapse in Fall of 2008 changed that for a moment as investors took their flight to "safety" but the secular trend has returned. Therefore, I expect the Canadian dollar to improve, and gold to go off the charts. I am betting against the US dollar--and it's making me money. Those who bet on the dollar are going to lose. I see signs of serious inflation already. But it is going to get much worse for the US dollar.

At very least, it is necessary to have a strategy that will help you to make money whether there is deflation or inflation. If your deflation strategy says go long on bonds and there is hyperinflation you lose. If you short the dollar, there is a way to win even if there is deflation--and that is by maintaining a large unused line of credit, to take advantage of the deals that are going to happen when the market collapses. In any case, that's what I'm doing. I've outlined the strategy here: http://righteousinvestor.wordpress.com/2010/11/02/aggresivity-or-gold-what-is-needed-in-the-current-investment-climate/ and here : http://righteousinvestor.wordpress.com/2010/11/04/deflation-or-hyperinflation-an-investment-for-both-at-the-same-time/

Cheers.

You are way more successful than me so don't let me cloud your thinking too much. But for what it's worth, I am bullish on the US$ in the long run. I am not sure if it has set a trough against the C$ but it wouldn't surprise me if it has (this is similar to my view that, although I am not certain, oil may have set a multi-decade peak in 2008). It's interesting that the US$ has been relatively strong, after an initial sell-off, since QE II was announced. For the year, it's largely flat against the C$. We'll see if this is a temporary thing or not.

ReplyDeleteAs for gold, I don't have a strong view of the near to medium term. I remain bearish and wouldn't go near it but I have been wrong for around 4 years. Gold is a bit harder to call since it is influenced by perceptions a bit more than other assets.

You would know a lot more about line of credits but just be careful with them. It is quite possible that your lenders will pull your unused credit line during stressful times. It depends on the contract you signed but I believe this was happening from 2007 to 2009 in America when banks were pulling HELOCs and reducing credit card loan limits (in cases where their loan agreement allowed them to). I follow the conservative thinking that the only safety in deflation is cash. Promised loans and the like may be totally unreliable (but I have to admit that I don't know much about them or what the legal terms).

BTW, have you ever considered the possibility of China slowing or entering a recession (say GDP growth drops to 6%)? Even if you don't expect it to happen, you may want to consider the consequences to your portfolio if that happens. Just something to watch out for.

ReplyDeleteThanks for these comments--and warnings!

ReplyDeleteIt is true what you say about lines of credit--because they are demand loans. The secured lines are probably less likely to be taken away, because if you default, the bank will simply foreclose on your house. But there is probably little to fear from the bank pulling any of my lines of credit thanks to the Bernanke put. Whatever shrinkage that might still occur will be eased, and the banks will stay in business.

China will eventually slow down, and there are some serious problems there--inflation, housing bubble, etc. But for now their investors are still flush with cash, which they are currently pooring into the Canadian energy sector, and that will help my resource weighted portfolio.

I am also a conservative investor, though I use leverage. With the help of Excel and its ability to pull stock prices from the internet, I track my debt to equity ratio with only a 15 minute delay. That ratio, assuming all the puts were to be assigned, is currently at 0.3. Many people when they buy their first house, have a much higher debt to equity ratio. Ours was about 2.5. The worst that could happen to my business, if all the lines of credit were pulled, as you suggest, would be that we would have to sell assets. That's seems a pretty remote possibility to me, and I can withstand a serious drop in the stock market and remain solvent--as we remained solvent in 2008-09, despite serious portfolio losses.

Finally, the greenback has experienced tremendous volatility--not so much flatness--against the loonie, gold and other major currencies. I short the greenback more during its periods of strength, and take profits during periods of weakness. Since these cycles are happening almost weekly, it helps my trading a lot. However, I do believe that the secular trend will be dollar weakness because that is the stated goal of the Federal Reserve. Cheers.